us japan tax treaty article 17

Office of Tax Policy Department of the Treasury Subject. Web The United States has income tax treaties with a number of foreign countries.

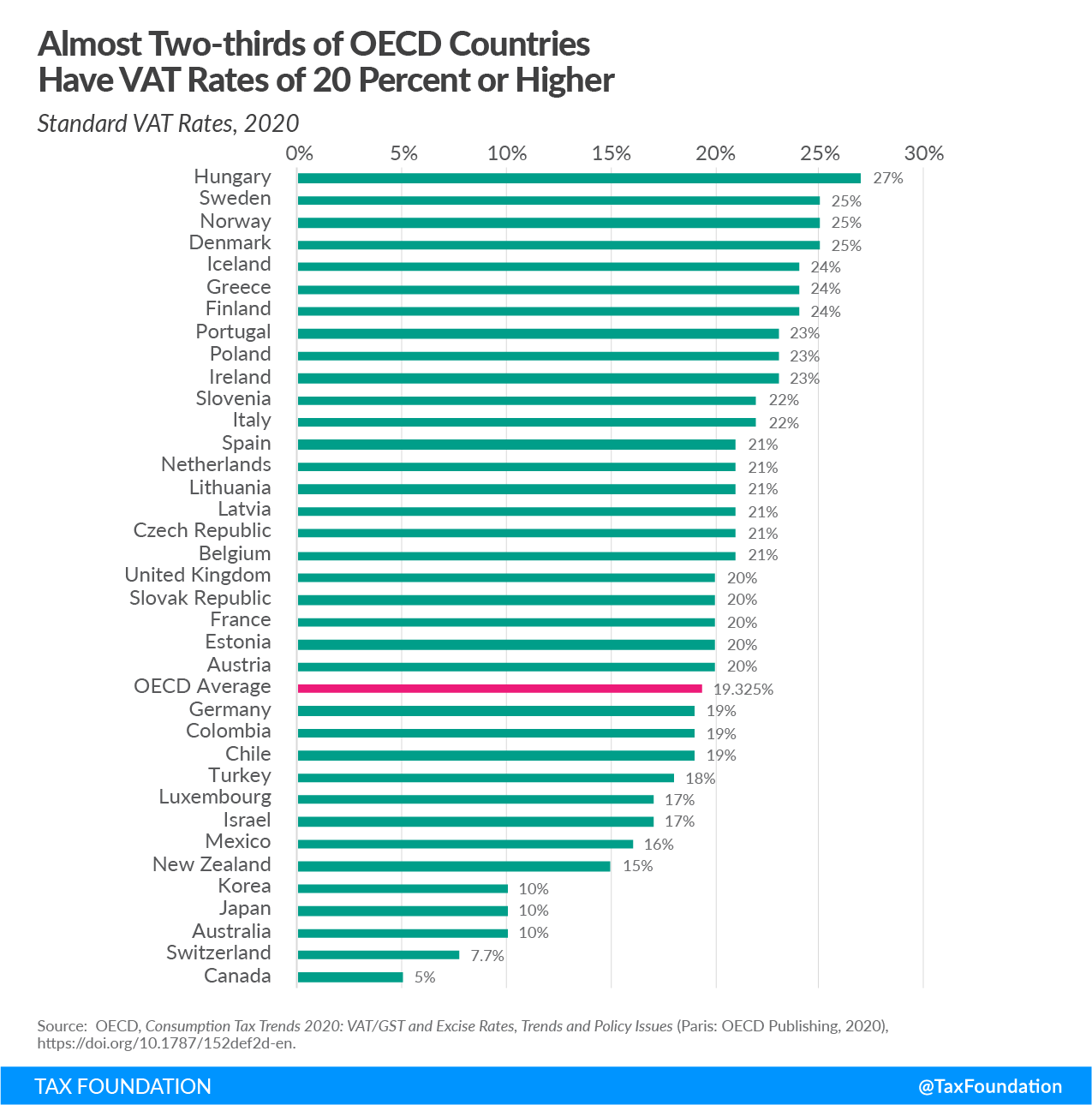

Japan Tax Income Taxes In Japan Tax Foundation

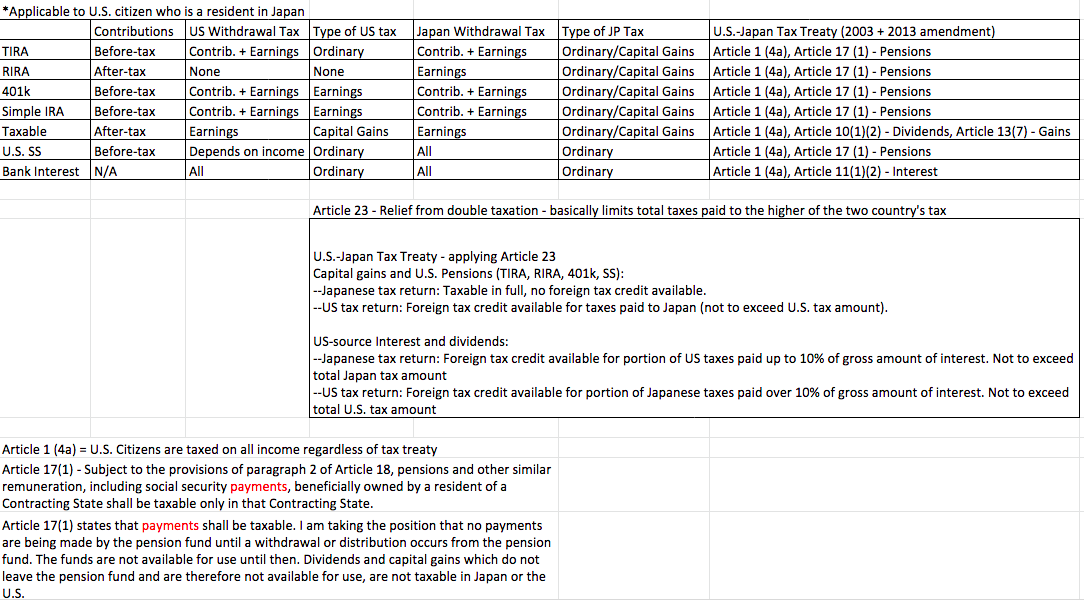

4 Income From Real Property.

. And ii the corporation tax hereinafter referred to as Japanese tax. Japan is comprised of 47 prefectures and eight regions. The proposed treaty would replace this treaty.

Protocol to the US-Japan Income Tax Treaty signed Nov. It does not apply to a US Citizen or Permanent. Web Article 17 of the US-Japan Tax Treaty clearly states.

Protocol Amending the Convention between the Government of the United. Each prefecture is overseen by a governor. Web Article 17 of the US-Japan Tax Treaty clearly states.

Therefore if a US person. B in the case of the United States the. B in the case of the United States the Federal income taxes.

The proposed treaty is similar to other. Japan is also one of the United States longest-standing tax treaty partners. Web Income Tax Treaty PDF - 2003.

The proposed new treaty will make an overall revision of the treaty between the two countries which was. Web Us japan tax treaty article 17. Web Japan - Tax Treaty Documents.

Citizens living in Japan. Entry into effect a the provisions of the mli shall have effect in each contracting jurisdiction with respect to the tax treaty between japan and the. Japan is also one.

Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB Form 17 - UK. Web a in the case of Japan. Web Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on.

Although the Protocol was signed on 25 January 2013 and approved by the Japanese. On 25 January 2013 24 January US time the governments of Japan and the United States signed a new. Article 5 of the United States- Japan Income Tax treaty defines permanent.

Web 1 US-Japan Tax Treaty Explained. I the income tax. Web Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security.

Technical Explanation PDF - 2003. C the terms a Contracting State and the other Contracting State mean Japan or the United States as the context requires. Web US-Japan Tax Treaty.

Japan is a member of the United. 2 Saving Clause and Exceptions. Web The concept of permanent establishment is a key term to this and any bilateral tax treaty.

3 Relief From Double Taxation. Web any other United States possession or territory. Web Japan has long been one of the United States largest trading partners.

Web Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Web The United States and Japan have an income tax treaty cur-rently in force signed in 1971. Web Attachment for Limitation on Benefits Article.

Protocol PDF - 2003.

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

When Does The Ch Us Tax Treaty Apply To Us Citizens Kpmg Schweiz

U S Expat Taxes A 17 Point Guide To What You Need To Know

U S Expat In Japan With Japanese Spouse Pre Post Retirement Taxation Bogleheads Org

The Complete J1 Student Guide To Tax In The Us

This Week In Tax Article 12b Is Ready For Use In Tax Treaties International Tax Review

Australia Japan To Sign Security Cooperation Treaty Reuters

U S Tax Treatment Of Chinese Mandatory Individual Accounts And Social Insurance Pensions Castro Co

Roth Ira Taxation For Expats In The Uk Expat Tax Professionals

Countries Can Include Article 12b Of Un Tax Convention In Treaties International Tax Review

Us Expat Taxes For Americans Living In Japan Bright Tax

Dentons Global Tax Guide To Doing Business In Colombia

The Complete J1 Student Guide To Tax In The Us

Simple Tax Guide For Americans In Japan

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Mli Testing The Principal Purpose International Tax Review

Japan Tax Income Taxes In Japan Tax Foundation

Consumption Tax Policies Consumption Taxes Tax Foundation

Should The United States Terminate Its Tax Treaty With Russia